Reading Time: minutes

KMC, one of the country's leading real estate brokerage and consultancy firms, held its webinar for the first half of the year to present the latest data on the Philippines’ property market and forecast what’s next for the commercial, industrial, retail, residential, and hospitality class assets in the real estate industry.

Executives of the company led the discussion on the sector’s performance in the late quarters of 2020 and presented data gathered by KMC’s Research Team and Information & Data Management Group (IDMG) on the performance of the industry during the time period.

Managing Director and co-founder Michael McCullough spearheaded the event and shared his insights on the industry, followed by other members of the company’s executive committee: Chief Operating Officer Cha Carbonell talked about the rising demand for industrial and warehouses in the country and how the industry keeps up. Meanwhile, Executive Director for Worldwide Occupier Services John Corpus elaborated on why the office remains relevant despite the pandemic and how it will shift in the coming years given the flexibility offered by companies in the new normal.

Residential Services Manager Aron Pritchard discussed the impacts of the Hub and Spoke office arrangement in residential real estate and co-living. He cited that as many people based in Metro Manila would prefer to relocate, housing options in neighboring parts of the capital will be an ideal location for families.

BPO, ECommerce, and Tech Companies Buoy Office Demand

Executive Director for Worldwide Occupier Services John Corpus noted that the majority of the movement in the office market was caused by the BPO, e-commerce, and tech companies which thrived amid the COVID-19 pandemic and despite community lockdowns.

He specified that internet services and infrastructure, outsourcing, and delivery companies have expanded since last year and continue to grow in terms of square footage in key locations in Metro Manila.

DOWNLOAD: KMC Metro Manila Office Briefing 1Q/2021

Converting Industrial Pledges into Actual Investments

Supported by the China Plus One strategy and the continuous boom of the e-commerce industry amid the pandemic, the sector has been bullish since the second quarter of 2020. KMC COO Cha Carbonell pointed out that while there is a nine-fold increase in the pledges for industrial real estate in the Philippines, the challenge lies in converting those into actual investments.

Carbonell noted that there are challenges that should be addressed in order to let these pledges materialize, including electricity cost, the ease of doing business, and political stability in the Philippines. On the contrary, she also presented the advantages and pros of locating in the country, citing the English proficiency of employees (for BPOs) and the stable and reasonable industrial land prices.

RELATED: KMC Industrial and Logistics Report 1H/2021

PH Residential Sector: Signs of Demand Recovery

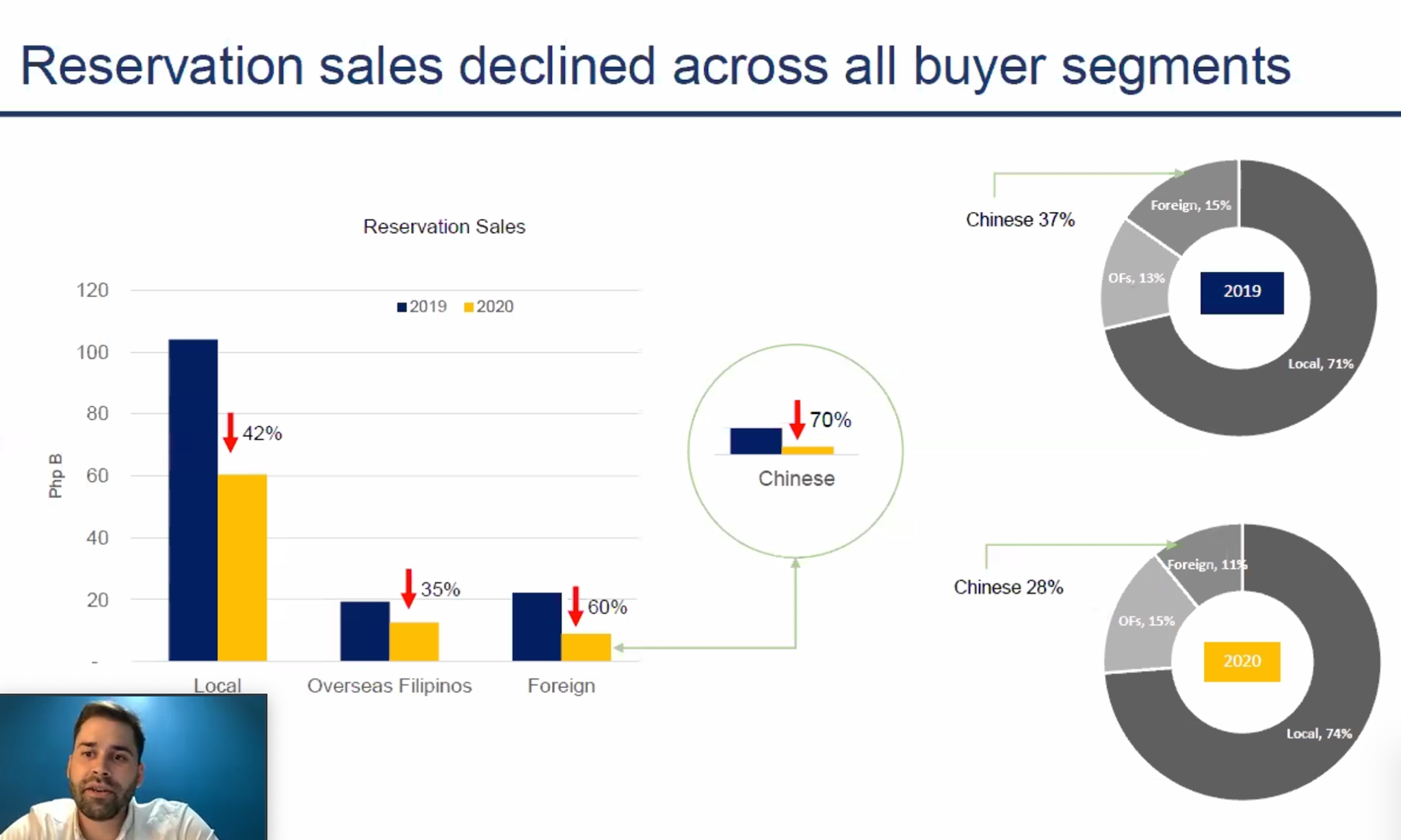

The country’s residential real estate market is showing signs of recovery, Residential Services Manager Aron Pritchard reported. He explained that this is evident by the increase in construction completions and the number of condominium units turned over in the first half of the year. However, he emphasized that despite this bright spot, property values remain stagnant.

Pritchard also highlighted how the Hub and Spoke office model and a more flexible working arrangement offered by businesses affected the housing market in the country. More home hunters are looking to relocate to neighboring provinces around Metro Manila and in the suburbs including Cavite, Laguna, and Rizal.

Vaccinations to revive Retail, Hospitality

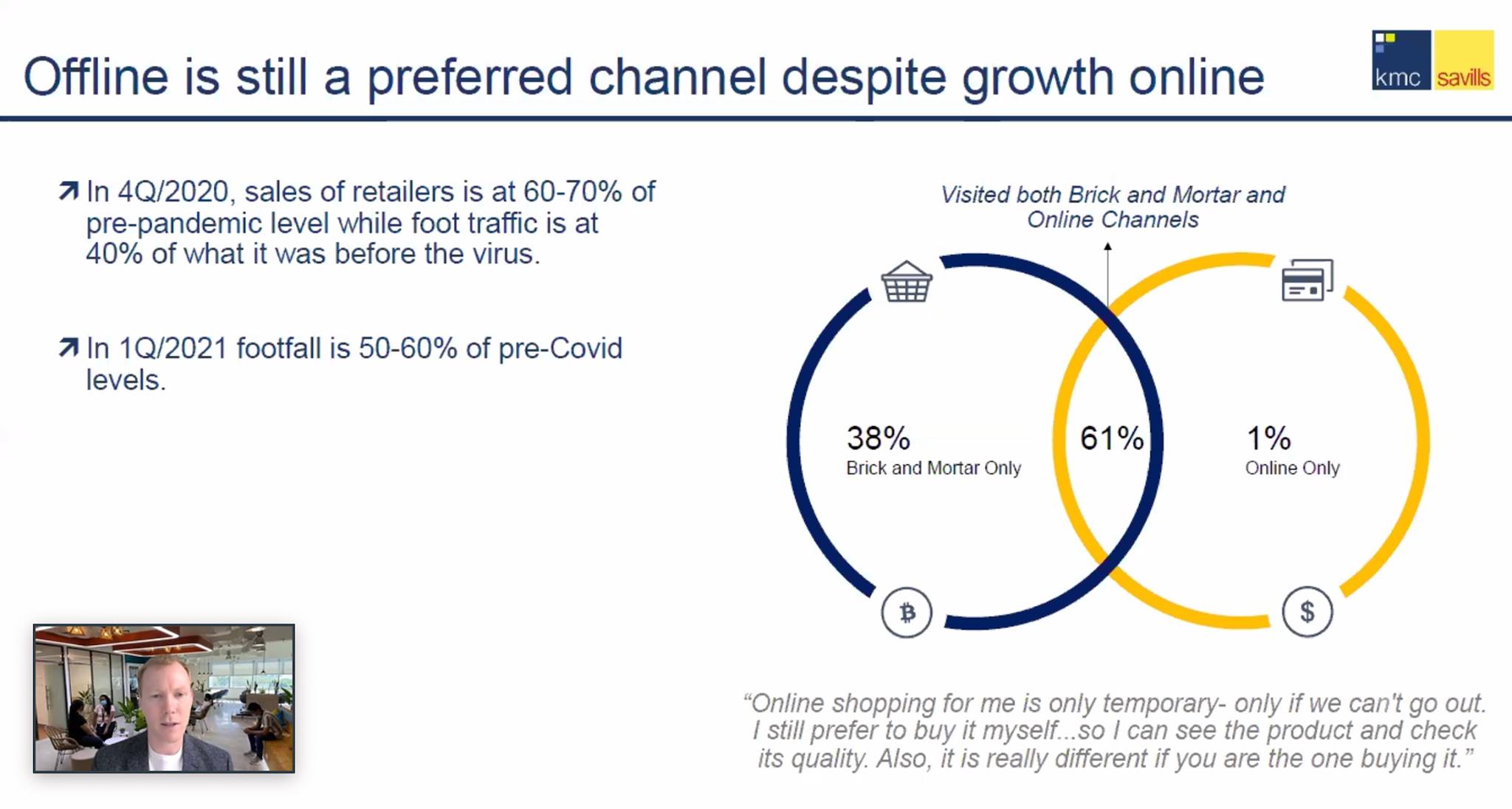

KMC Managing Director Michael McCullough expressed that given the ramped-up vaccination against COVID-19 in the country’s key locations, the retail and hospitality sectors of real estate will recover soon. He added that despite the market shift in retail as a result of the e-commerce boom, Filipino shoppers prefer a more experiential approach to shopping.

The same can be expected in the hospitality and leisure sector in the Philippines as the government eases travel restrictions to assist the local tourism industry. McCullough also noted that the industry was also affected by the number of foreigners leaving the country to go back to their home countries, and the number of Overseas Filipino Workers (OFWs) returning home.

Want to get more in-depth market data and analysis? Contact us today! Call (+63) 2-8403-5519 or send an email to [email protected] to let us know how we can help you.