Reading Time: minutes

The Cebu office market continues to remain attractive for locators who consider the district as a secondary or even primary site. This is evident in the fact that vacancy rates are less than half compared to the first quarter, down to 2% from 5%. A solid uptake of 26,808 sq m is one reason but the limited supply should be considered a major factor. It is clear that developers consider Cebu market an attractive investment with 292.366 sq m of Grade A Office space being planned the coming three years. This will increase the stock by more than 50%, clearly showing the interest in the Cebu office market on the supply side as well.

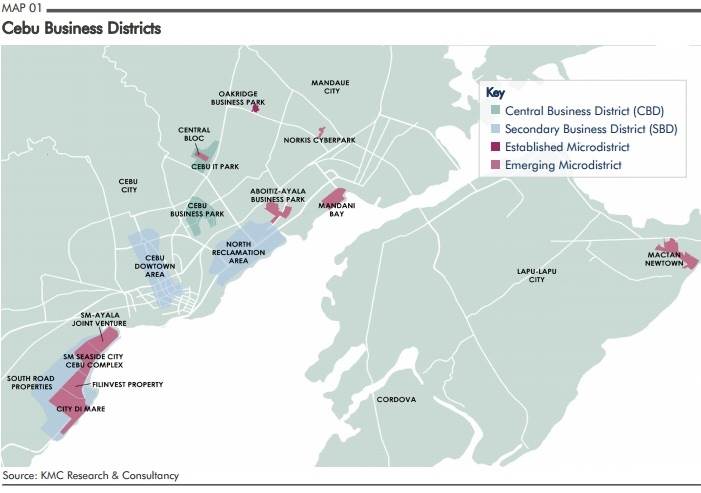

Furthermore, the low vacancy rates are one reason for the continued acceleration in YoY growth of rental rates, increasing 4.6% compared to last year. This is the seventh quarter in a row that the YoY increase of rental rates have accelerated once again showing how Cebu have become an increasingly attractive location. An increase of Php 500 per sq m/month was observed in all districts with Cebu Business Park and Cebu IT Park rental rates charging the most at PhP 528.6 and PhP 526.4 per sq m/ month, respectively. The large increase in supply that was mentioned earlier is likely to lessen the YoY rental growth as well as increase the vacancies in the medium term.

The biggest announcement during the quarter was the local government's auction of two South Road Properties. With a combined size of 44,2 hectare the properties, bought by Ayala Land-SM and Filinvest, are to be considered substantial. As we look towards the future, it's fair to say that the properties are posed to influence the dynamics of the Cebu real estate market given the significant real estate activity they will cause as reclaimed land is transformed into a mixed-use central business district.