Reading Time: minutes

Last Tuesday, the Government Service Insurance System (GSIS) received a record-breaking Php 500,000 per square meter offer for one of its prime lots in Bonifacio Global City, Taguig, equivalent to Php 800-million. The offer price for its other BGC lot is not far off, reaching Php 458,000 per square meter or Php 733-million.

This got us wondering: are the prices too much?

Sure, the prices can be justified by virtue of that fact that the lots are in a prime location. They are located right in the heart of BGC, a few meters away from major retail developments (The Fort Strip and Bonifacio High Street), as well as high-rise offices and residential buildings. However, this might not be enough to justify how the price skyrocketed by 80% in a year. Last year (October 2013), the Social Security System (SSS) sold its BGC prime lot (located close to the lots in question) at a mere Php 277,000 per sq. m.

Is it worth it?

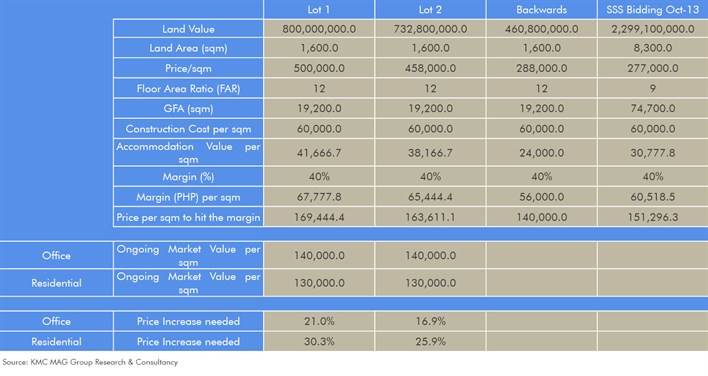

We have provided a couple of rule of thumb calculations that will help us determine if the price is justified and whether it is a good investment.

As we know, land is not an income-producing asset such as stocks or an office building. Rather, it is an option: you may opt to develop the land and sell it at higher price later on (exercise the option), meaning, you are locking the future price today. So investing in a land means that you are participating in a derivatives market, so it allows you to either speculate or hedge.

Analysis 1: Exit Price

First, we need to calculate how much the exit price should be for an investor to make his profit or exercise his option. To do this, you have to look at the cost of the developed property that consists of land cost, construction cost, and profit margin of the owner.

Now, if the land costs Php 500,000 per sq. m., this means that you would need to sell the end product at Php 170,000 per sq. m., given certain assumptions. Comparing this to the current market value of Php 140,000 per sq. m., you are speculating that the prices of the end product will increase no more than 21%.

Fair Market Value

We can also do this backwards and determine the fair value for this property by taking the price of an end product as given (from the market). According to our findings, the fair market value of this land should be around Php 290,000 per sq.m., which in our opinion, is close to the current market value for land in BGC or for this specific lot. Of course this is applicable to certain characteristics of the property, such as FAR and the profit margins required by the developer.

Again, looking back at the transaction of the SSS lot last October, "our opinion on fair market value" would have meant that the price increase for the year was around 4%, which is very close to the inflation rate and which should be considered as the average growth rate in the long term. If the underlying demand for properties (such as favorable demographics or BPOs) is expected to exceed supply, then the faster growth can be justified.

However, the million-dollar question here is (or $18-million in this case), if the underlying demand is that strong that it would justify an 80% (Php 500,000 over Php 277,000) price increase of land per annum. If you forecast the market conditions a few years ahead, well, no.

Analysis 2: Office Investor's Perspective

We can also look at this from the perspective of an office investor. It will be interesting to analyze which parameters would justify the Php 170,000 per sq. m. price.

Given the new supply in BGC, if you are a landlord, you are pretty much a price taker when you estimate your achievable rent levels. Applying current market rates, since the average rent level in BGC is at Php 800 per sq. m. (there are not many buildings in BGC that are fully leased out at a higher price than this if any), the cap rate for Php 170,000 per sq. m. would settle somewhere between 5.5% and 6%.

Comparing this to the latest transaction of Accralaw Tower at around 9%, the investors would be compressing cap rates. This scenario could be a dangerous precedent, especially if you look back at what happened during the financial crisis. Also, comparing this to Philippine gov't bond yield of 4%, your yield spread or risk premium would be only 1.5%-2%. Is this enough to cover the risk of property investment in PH? Maybe not. For a very long-term local investor it could be, but we don't think so.

Analysis 3: Why didn't Megaworld go absolutely crazy and outbid everyone for this property?

When this information came out, the stock prices of Megaworld and Ayala went up significantly. This kind of a market reaction created an arbitrage opportunity.

Again, the multi-billion question here is why didn't Megaworld participate in the bidding? By participating in this bid, they stood to gain more.

With the Php 500,000 per sq. m. price, Megaworld's stock price went up by 8.3% in one day, meaning the value of the company increased by Php 12-billion. However, if Megaworld would have outbid everyone and offered, say, Php 600,000 per sq. m., this could have increased the stock price even more, say, 15% due to the more attractive NAV-discount. In terms of Php that would mean Php 22-billion gain in market value of the company. If you deduct the value of the transacted property, which is Php 960 million at Php 600,000 per sq. m., the gain would have been Php 21-billion instead of only Php 12-billion.

Despite this being a great opportunity for developers, I am thankful that the CFOs of the companies (Megaworld, Ayala Land, Inc., etc.) decided to not participate in the bidding. As doing so, it would have artificially pushed the values up the rate ceiling and put the country at greater risk into a property bubble.This is a good sign and shows that they know what they are doing in the long term.

More questions

Our analysis creates more questions. First, what is the motivation of the buyers for this property? How did they value the property and decide how much to offer?

Second, what are the implications of this transaction? Is this the start of new trend or a symptom of the looming asset bubble?

Although we can't decipher what the motivations of the bidders are, we are certain that treating this transaction as the new trend would compress the cap rates to 5%, and give the property a trophy asset status, meaning BGC will be seen as the most prime location in the Philippines. Benchmarking this, comparable transactions or trophy assets in Singapore are transacted below a cap rate of 3%. Are we there yet?

Either way, justifying this price would involve a lot of speculation on market performance and rates going up. In spite of the promising property market, an investor still needs to exercise caution and justify if a 21% price increase is rational, or if it can be justified by the fundamentals. Are rents expected to increase so fast? Or are investors just compressing cap rates, meaning that the risk of property investment has been reduced significantly?

Hopefully, this transaction will be treated as an outlier and the market does not absorb this as a new level, not yet.

Greater need for transparency, expert real estate investment advice

The values of the listed real estate companies are usually based on their Net Asset Value (NAV). If a large audience believes that this transaction made the market value of the properties in BGC go up, it will naturally affect the NAVs of real estate companies who have presence in BGC. Investors should remember that stock analysts are not necessarily real estate professionals, so when they give recommendations based on NAV-discounts, think twice. With only looking at NAV-discount, they could mislead you and recommend a strong BUY for these stocks, which would then increase the stock prices.

Assuming that the developers' asset values increased due to the transaction does not make sense since the assessment of the property does not match its fair market value.

This situation demonstrates the great need for accurate real estate research and valuation. Valuing the properties correctly and providing the right market value will reflect the market conditions correctly and steer PH away from a looming asset bubble.

Since public real estate companies are not always using independent appraisers when valuing their portfolio, it is important for an investor to be careful with their NAV.

That being said, now there exists a greater opportunity in the stock markets. In a couple of weeks, there will be a new round of quarterly reports released. Pay extra attention on the investment properties section, if the asset values went up or no, and then make your conclusion.

Meanwhile, I am loading put options in my portfolio and have started short selling these companies (if it would be possible in the Philippines). Let's see how it goes.